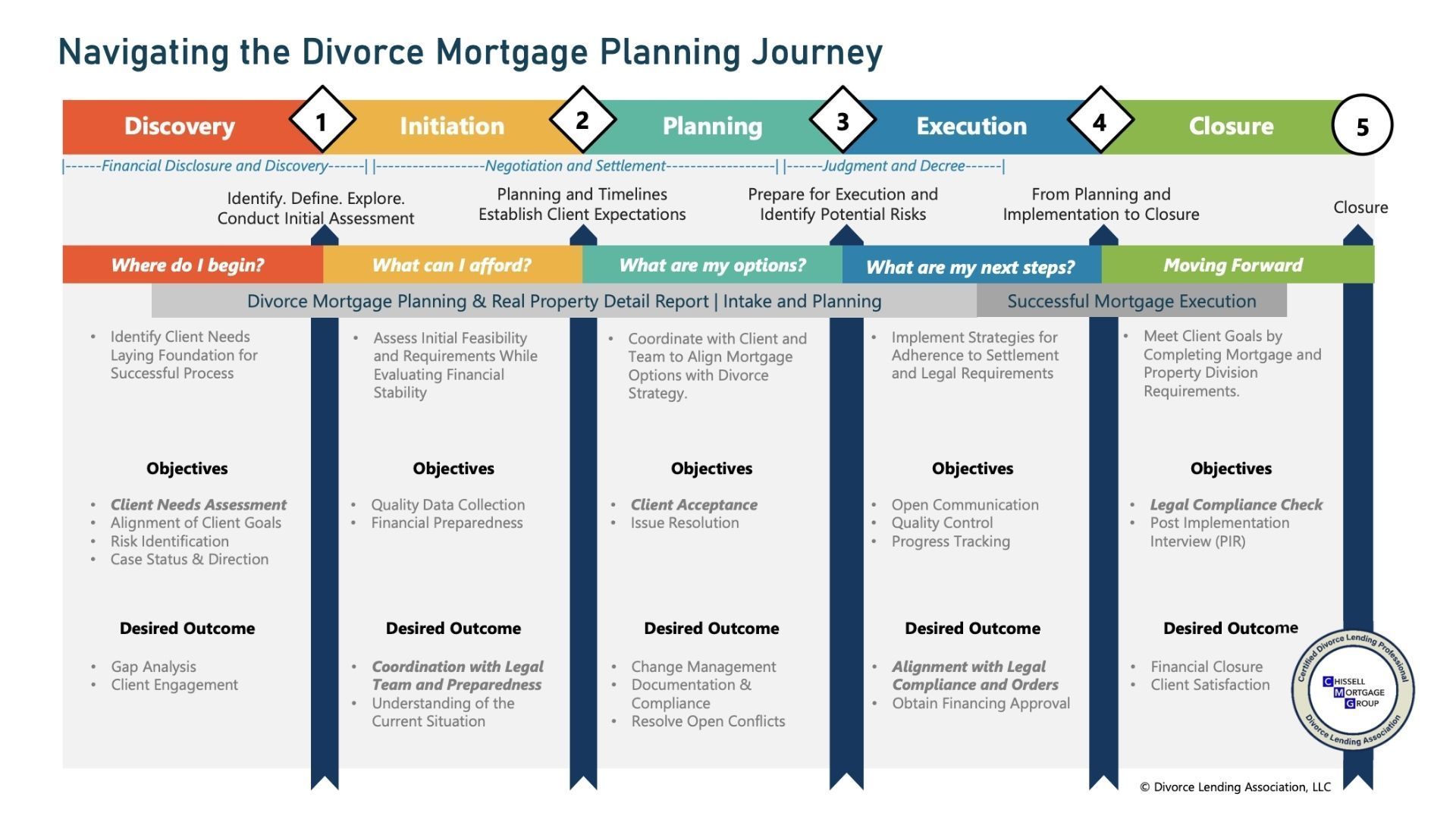

The 5 Phases of Divorce Mortgage Planning with Expert Insights

Step through the phases of divorce mortgage planning with expert commentary and analysis to help secure your financial future with confidence.

Divorce Mortgage Planning Phase: In-Depth Analysis

Divorce is a complex financial transition, and handling real estate assets can be one of the most challenging aspects. Whether you’re determining affordability, evaluating mortgage options, or finalizing property division, having a structured approach ensures financial stability and legal compliance.

This guide walks through the five key phases of divorce mortgage planning, helping you make informed decisions at every step. Additionally, we provide expert commentary and analysis to offer real-world context and deeper insights into each phase.

1. Discovery: Where Do I Begin in Divorce Mortgage Planning?

The first step in divorce mortgage planning is understanding the financial landscape and gathering the necessary information to lay a strong foundation.

Objectives:

- Client Needs Assessment – Identify individual financial goals and needs.

- Align client goals with mortgage strategies.

- Identify risks and assess case status & direction.

Desired Outcome:

- Gap Analysis – Uncover any missing financial details.

- Client Engagement – Establish a roadmap for the mortgage planning process.

Commentary & Analysis:

The discovery phase is crucial because it sets the stage for all future decisions. Many divorcing individuals underestimate how their financial standing impacts mortgage eligibility. By proactively gathering data on income, assets, debts, and credit scores, you can avoid last-minute surprises. Seeking guidance from a financial expert at this stage can prevent delays and missteps later.

2. Initiation: What Type of Mortgage Can I Afford After Getting a Divorce?

Once the discovery phase is complete, assessing financial feasibility is crucial to determine affordability and legal preparedness.

Objectives:

- Quality data collection and financial preparedness.

- Evaluate income, credit, and asset stability.

- Coordinate with the legal team to align mortgage decisions with the divorce strategy.

Desired Outcome:

- Coordination with Legal Team & Preparedness – Ensure financial decisions comply with legal agreements.

- Understanding of Current Situation – Clarify financial standing and potential mortgage pathways.

Commentary & Analysis:

Affordability often becomes a major stress point in divorce mortgage planning. Many individuals assume they can afford to keep the marital home without fully analyzing post-divorce expenses. A clear financial assessment, including a future budget, is critical. Consulting with both legal and mortgage professionals ensures that your mortgage decisions align with your long-term financial health.

3. Planning: What Are My Morgage Options?

This phase involves exploring available mortgage solutions and aligning them with the divorce settlement.

Objectives:

- Client Acceptance – Ensure alignment between financial goals and available mortgage options.

- Resolve outstanding financial issues to smooth the transition.

Desired Outcome:

- Change Management – Adapt financial strategies to post-divorce realities.

- Documentation & Compliance – Ensure all paperwork meets legal and lender requirements.

- Resolve Open Conflicts – Address potential disputes before execution.

Commentary & Analysis:

Many divorcing homeowners struggle with deciding whether to refinance, sell, or assume the mortgage. Each option has distinct financial implications. Refinancing can allow one party to keep the home, but qualification is often challenging on a single income. Selling may be the most practical solution but can be emotionally difficult. Understanding these trade-offs early prevents rushed decisions that could impact long-term financial stability.

4. Execution: What Are My Next Steps?

Once the plan is in place, the focus shifts to executing mortgage solutions in compliance with legal agreements.

Objectives:

- Maintain open communication between all parties.

- Ensure quality control and progress tracking to prevent delays.

- Implement strategies to adhere to the settlement agreement and court orders.

Desired Outcome:

- Alignment with Legal Compliance & Orders – Ensure property division meets legal requirements.

- Obtain Financing Approval – Secure necessary mortgage approvals and finalize financial transitions.

Commentary & Analysis:

This stage requires close coordination between legal teams, lenders, and financial advisors. Unexpected obstacles, such as discrepancies in property valuations or settlement terms, can arise. Staying proactive and ensuring all parties are aligned prevents delays. If issues emerge, having a contingency plan in place can make the execution phase smoother.

5. Closure: Moving Forward

The final phase is about successfully completing the mortgage and property division process while ensuring financial security.

Objectives:

- Legal Compliance Check – Conduct a post-implementation review to confirm all obligations are met.

- Complete the mortgage process and property transfer.

Desired Outcome:

- Financial Closure – Ensure all mortgage and financial obligations are resolved.

- Client Satisfaction – Provide a stable foundation for post-divorce financial success.

Commentary & Analysis:

The closure phase marks the transition into post-divorce financial independence. Ensuring all legal and financial responsibilities are finalized provides peace of mind. It’s also a good time to reassess long-term financial goals, update estate plans, and create a sustainable budget that reflects your new circumstances.

Secure Your Future with Divorce Mortgage Planning

Divorce mortgage planning is a structured journey that requires careful financial and legal coordination. Whether assessing affordability, exploring mortgage options, or ensuring compliance with court orders, each step is crucial to achieving a smooth transition.

For expert guidance through this process, contact Mike Chissell to navigate your next steps with confidence.

Start Your Home Loan with Chissell Mortgage Group.

Your local mortgage broker.

NMLS #2062741